EAST MED E&P: OUR BUSINESS ENVIRONMENT

GEOLOGY

The Levant Basin is one of the world’s most promising and least explored hydrocarbon regions.

LEVANT BASIN

By the early 1970s, several significant reservoirs of gas and oil had been discovered in the Levant Basin, including at the mouth of the Nile and on the land shelf in Sinai. Within Israel’s EEZ, several small onshore oil reservoirs were found over the years, but no major finds.

However, a variety of indications, together with the proximity of the region’s larger reservoirs to Israeli waters, led several pioneering Israeli entrepreneurs to search persistently for oil and gas fields. For nearly two decades, Delek and its partners explored, drilled and invested, making their first major discoveries (Noa and Mari B) in 1999 and 2000. In 2009, Delek and its partners discovered the much larger Tamar and Dalit reservoirs.

Since then, Delek and its partners have made a number of major discoveries, including Leviathan, Tanin, Dolphin, Aphrodite, Karish and Tamar SW. All of these discoveries were located in the Levant Basin’s Tamar Sands reservoir section.

THE TAMAR SANDS RESERVOIR SECTION

1973

“Moses dragged us for 40 years through the desert to bring us to the one place in the Middle East where there was no oil,” Golda Meir, 4th elected and 1st female Prime Minister of Israel.

2009

“Delek Group’s vision and major offshore discoveries will transform Israel into an energy exporter,” Yitzhak (Isaac) Tshuva, Delek Group’s Controlling Shareholder.

POTENTIAL OF THE LEVANT BASIN PROVINCE

In late 2010, the United States Geological Survey (USGS) published an analysis of the quantity of potentially-recoverable natural gas and oil located within the Levant Basin, including the onshore area up to the fault line of the Dead Sea. According to this analysis, which was published after the drilling of the Tamar and Dalit wells but before the drilling of the Leviathan exploration well, the best estimate (P50) of the potential of the entire Levant Basin area, including both onshore and offshore regions, is approximately 112 TCF of natural gas and approximately 1.4 billion barrels of recoverable oil.

Based on this estimate, excluding the 40 TCF of natural gas which were discovered thus far offshore Israel and Cyprus, it would appear that potentially more than 70 TCF of natural gas and more than 1 billion barrels of oil remain to be discovered in the entire basin, with a considerable portion of this potential located within Israel’s EEZ.

Israel’s Ministry of National Infrastructures, Energy and Water Resources recently updated its study of the hydrocarbon potential of Israel’s EEZ based on a comprehensive Basin Modelling and Petroleum System Analysis conducted by Beicip-FranLab (2015). The results of the study are highly encouraging, indicating unrisked volumes of 7700 BCM of gas and 26 billion barrels of oil (P50 in place); and Yet-To-Find volumes of 2,100 BCM of gas and 6.6 billion barrels of oil (P50 in place) in the Israeli EEZ. The recent discovery of gas in Miocene carbonate in the Zohr Field offshore Egypt, indicates that other hydrocarbon plays and giant traps may still be found in the Levant basin offshore Israel.

Sources:

The Levant Basin Offshore Israel: Stratigraphy, Structure, Tectonic Evolution and Implications for Hydrocarbon Exploration

Assessment of Undiscovered Oil and Gas Resources of the Levant Basin Province, Eastern Mediterranean

ISRAEL’S DEMAND FOR NATURAL GAS

ISRAEL’S ENERGY REVOLUTION

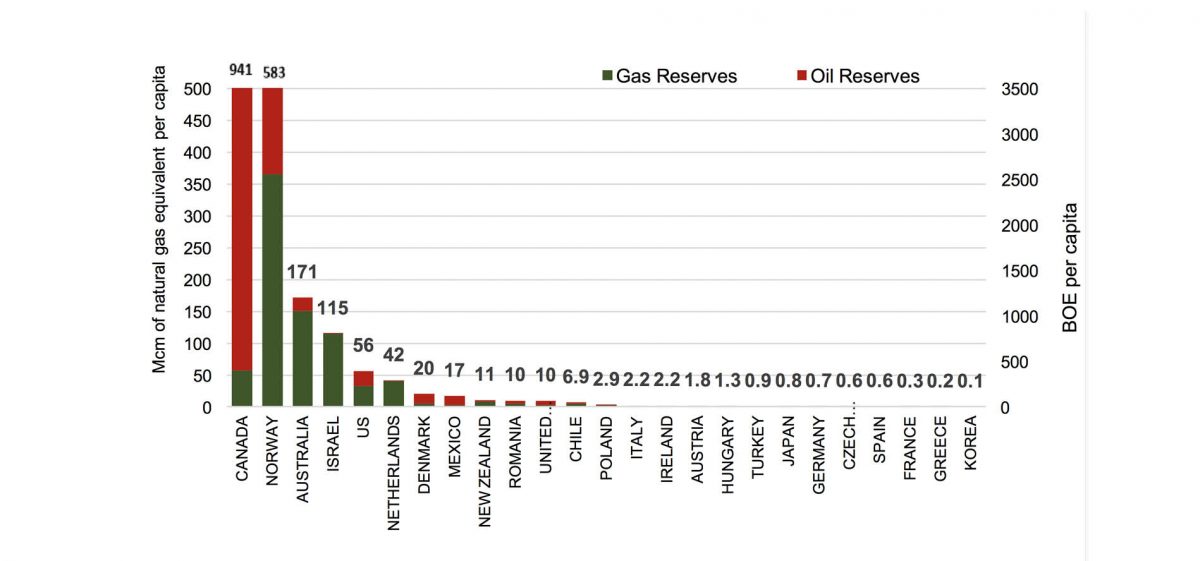

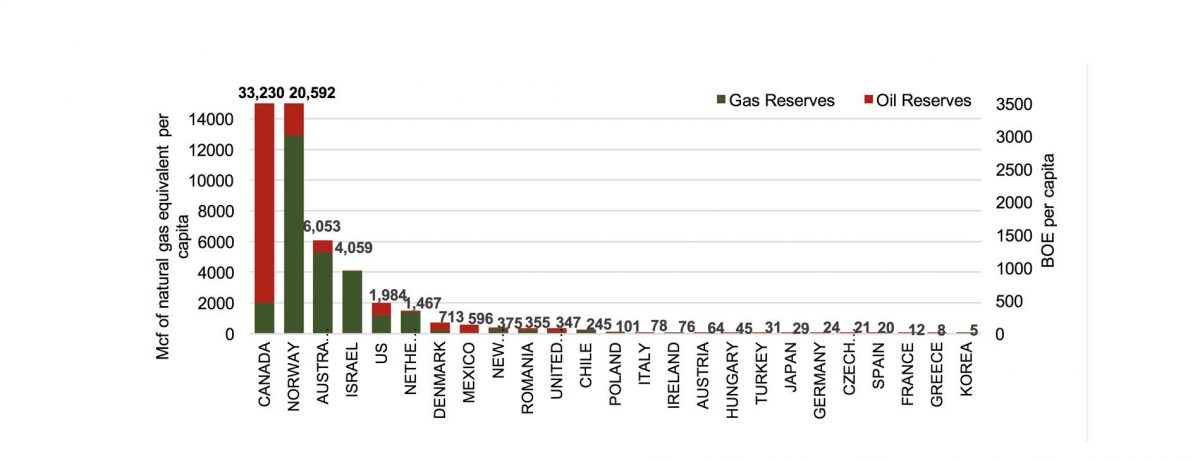

Today, following the discovery of Israel’s Tamar and Leviathan gas fields, Israel is ranked fourth in the OECD in terms of gas and oil reserves per capita. This plentiful supply creates a comparative advantage for Israel to develop advanced, capital- and energy- intensive, environmentally-friendly gas-based services and industries.

ENERGY RESERVES PER CAPITA IN OECD

Mcm/BBOE, OECD countries*

ENERGY RESERVES PER CAPITA IN OECD

Mcf/BBOE, OECD countries*

*Remaining OECD countries have no proven gas reserves

Source: BP Statistical Review of World Energy, CIA Factbook, NSAI and BDO Analysis

From an economic perspective, compared to other OECD countries, Israel should benefit greatly from its switch to natural gas from coal and oil to power electricity production plants, gas-based transportation, electric vehicles, and other energy-intensive applications.

Following is a summary prepared for the Delek Group by the BDO Consulting Group of the drivers and growth projections of the Israeli market for natural gas (as of September 2017). For the full report, please click here.

According to BDO’s analysis, demand for natural gas and electricity in Israel is still far from the saturation point. The combination of several factors, including Israel’s climatic conditions (the fact that Israel is the warmest of all OECD countries), the gap between Israel’s GDP per capita and that of other developed countries, and the low capital intensity level of Israel’s industrial and service sectors compared to other developed countries is expected to translate into an inherently higher growth rate for its demand for electricity as compared to other OECD countries.

Although 13 years have passed since natural gas started flowing into the Israeli market, Israel’s economy has only begun changing the structure of its energy sector, with Israel’s electricity sector and large industrial customers so far completing only a preliminary shift from oil to gas and taking first steps to reduce their coal usage.

ISRAEL NATURAL GAS CONSUMPTION BY GAS SUPPLIER, 2005-2016 (BCM)

ISRAEL NATURAL GAS CONSUMPTION BY GAS SUPPLIER, 2005-2016 (BCF)

Source: Natural Gas Authority and BDO analysis

To date, further gas utilization by the Israeli economy has been restricted by supply constraints. However by 2020, when Leviathan gas is expected to enter the market, Israel’s standing will change. For the first time, Israel will have more than adequate gas resources to meet local consumption, enabling it to become a significant gas exporter. This will enable the Israeli economy to fully utilize the economic and environmental benefits that will flow from its domestic production of natural gas.

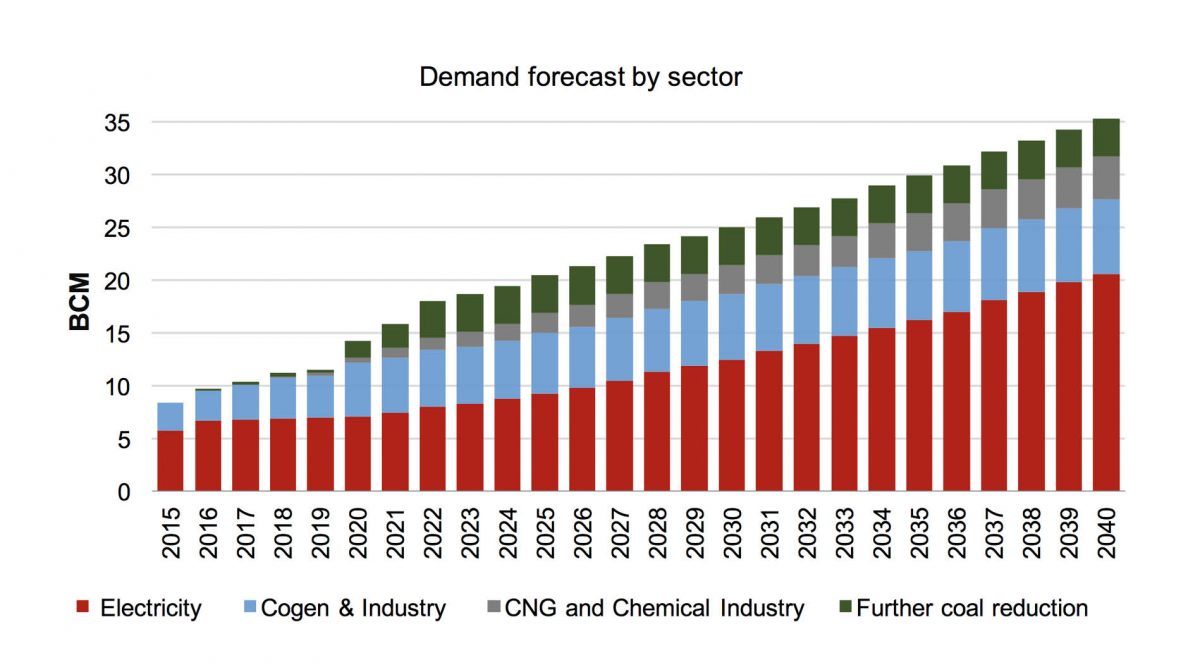

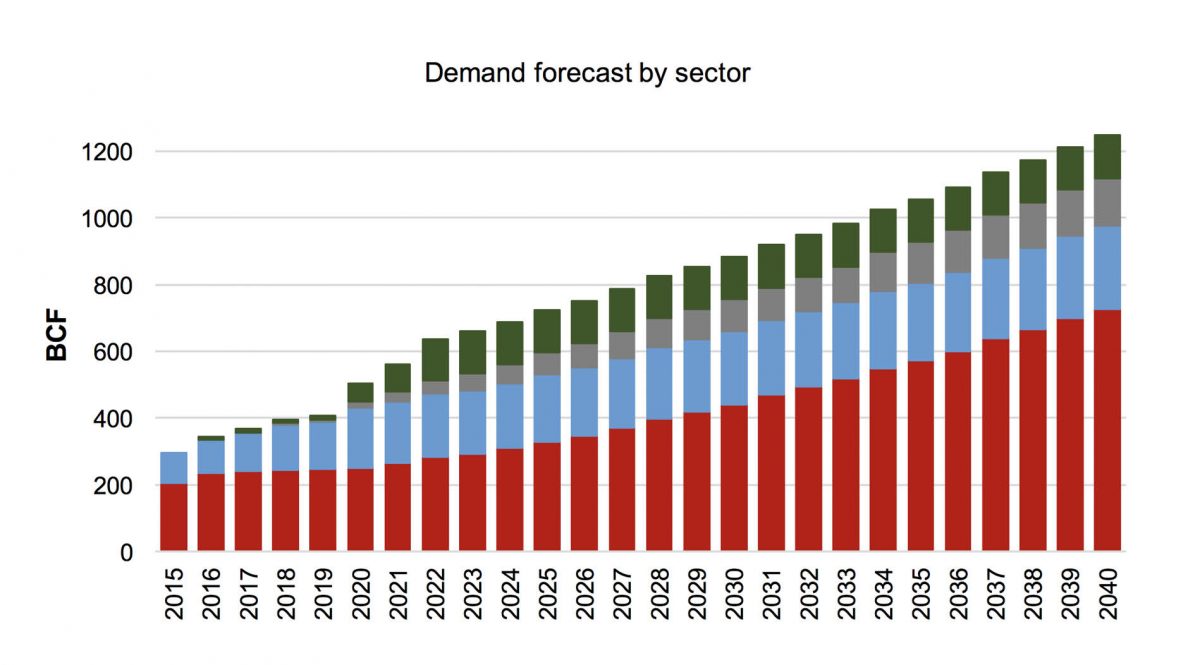

According to BDO’s forecast, Israel’s demand for gas is expected to double in less than a decade to reach 20.5 BCM (723 BCF) in 2025. The main growth drivers of this increased demand will be the continued structural change of the energy sector, further reduction in the use of coal for power generation, and a continued annual 3.5% rise in demand for electricity.

FORECAST FOR ISRAEL’S NATURAL GAS DEMAND: SUMMARY

Over the past decade, gas demand in Israel increased at an average rate of 17.5% per year, reaching 9.7 BCM (342.5 BCF) in 2016. Gas demand for 2017 is expected to reach 10.5 BCM (370.7 BCF), and BDO forecasts that local gas demand will increase by an average rate of 8% per year for the next decade, reaching 14.3 BCM (505 BCF) by 2020 and 20.5 BCM (723 BCF) by 2025. It should be noted that BDO’s forecast is based on potential demand, and does not account for supply side limitations. However, after the entry of Leviathan’s gas into the market, the supply of gas should be more than adequate to cover Israel’s local demand. In the short term, if available gas resources fail to cover local demand, local supplies may be supplemented by the import of LNG or diesel.

GAS DEMAND FORECAST 2015-2040*

In BCM

GAS DEMAND FORECAST 2015-2040*

In BCF

*Including the Palestinian Authority

Source: BDO Forecast

Based on BDO’s estimates, Israel’s electricity demand will increase by approximately 3.8% per year over the next decade, representing a 7% per year increase in gas demand by the electricity generation industry (approximate, all other factors remaining constant). Israel’s total gas demand is expected to grow by 9.5% per year through 2025, driven primarily by the Israeli government’s recent decision to shut down 1,440 MW of coal units and to increase the use of gas in industrial and transportation applications.

GAS DEMAND FORECAST SUMMARY

Demand by Type of Gas Consumer, in BCM

|

Year

|

Electricity

|

Cogen & Industry

|

CNG and Chemical industry

|

Further coal reduction

|

Total Demand

|

Out of which, Palestinian self-generation

|

|---|---|---|---|---|---|---|

| 2017 | 6.8 | 3.3 | 0 | 0.3 | 10.4 | |

| 2020 | 7.1 | 5.1 | 0.5 | 1.6 | 14.3 | |

| 2025 | 9.3 | 5.7 | 1.9 | 3.6 | 20.5 | 1.7 |

| 2030 | 12.5 | 6.2 | 2.7 | 3.6 | 25.0 | 2.8 |

| 2040 | 20.6 | 7.1 | 4.0 | 3.6 | 35.3 | 6.2 |

Demand by Type of Gas Consumer, in BCF

|

Year

|

Electricity

|

Cogen & Industry

|

CNG and Chemical industry

|

Further coal reduction

|

Total Demand

|

Out of which, Palestinian self-generation

|

|---|---|---|---|---|---|---|

| 2017 | 240.1 | 116.5 | 10.6 | 367.2 | ||

| 2020 | 250.7 | 180.1 | 17.7 | 56.5 | 504.9 | |

| 2025 | 328.4 | 201.3 | 67.1 | 127.1 | 723.9 | 60.0 |

| 2030 | 441.4 | 218.9 | 95.3 | 127.1 | 882.8 | 98.9 |

| 2040 | 727.4 | 250.7 | 141.2 | 127.1 | 1246.4 | 218.9 |

Source: BDO Forecast

According to BDO, the main factors driving the increase in Israel’s gas demand include the shift to the usage of natural gas by the local electricity generation, heavy industry and transportation sectors. The Israeli government is taking a hands-on approach to its regulatory activities, approving funding initiatives for expanding the country’s gas infrastructure and incentivizing private entities, while simultaneously legislating the reduction of coal usage.

ISRAEL’S NATURAL GAS EXPORT POLICY FOR ELECTRICITY GENERATION

Israel’s demand for electricity is not on par with that of comparable high-income regions with similar weather conditions. In the past 20 years, Israel’s electricity demand rose by an average rate of just 4% per year, representing just 2.2% growth per capita. This relatively low level of electricity consumption reflects a standard of living that is 30% lower than other comparable developed countries. In the coming years, Israel’s standard of living is expected to rise, and it will be accompanied by an increase in electricity consumption that narrows the gap between Israel’s electricity consumption and that of other developed warm weather regions with high-income levels.

BDO projects that Israel’s electricity demand will grow by approximately 3.5% per annum (approximately 1.7% per capita), reaching 131 billion kWh by 2040. The addition of demand from the Palestinian market is expected to increase total demand to 161 billion kWh in 2040.

In 2016, gas-based units constituted 67% of the Israeli effective generation capacity (accounting for the reduced availability of renewable units) but generated only 62% of Israel’s electricity production, due to a higher utilization rate of existing coal plants.

Israel’s coal units were planned and built in the 1980’s and 1990’s, long before the discovery of Israel’s gas reservoirs. At that time, coal usage for baseload production provided an economical viable alternative to fuel oil.

The availability of locally-produced natural gas, combined with the Israeli government’s current environmental and regulatory policies , should create a shift in Israel’s electricity energy fuel mix. From the point of view of the national economy, natural gas is a cheaper alternative that generates less pollution (SOX and NOX) and GHG emissions, thus enabling Israel to fulfill its international commitments under the COP21 framework. To date, lack of an adequate supply of gas has been the primary factor that has prevented further reduction of Israel’s coal usage. Currently, coal power plants in Ashkelon and Hadera provide 4,840 MW of the country’s 17,585 MW total installed capacity. As Israel’s supply of available gas rises, it is likely that the Israeli government will continue strengthening its policies regarding the reduction of coal usage, instructing the IEC (Israel Electric Company) to further reduce its utilization of its coal units.

In December 2015, Israel’s Ministry of Energy directed the IEC to reduce its coal usage by 15% in order to reduce emissions, and later increased the requirement to 19% beginning in 2017. In August 2016, after regulatory uncertainties that delayed the development of Leviathan were resolved, the ministry ruled that four coal units with a total capacity of 1,440 MW (Rabin A) in Hadera (30% of Israel’s coal production capacity) must be shuttered by June 2022. In November 2016, Israel’s Minister of Energy declared that the country was targeting for over 80% of its electricity generation to be fueled by natural gas.

The following forecast is based on the assumption that the next stage of Israel’s coal reduction will take place after Leviathan enters into the market in 2020, when adequate gas resources become available.

ELECTRICITY CAPACITY AND GENERATION FORECAST BY FUEL

In MW*

|

Year

|

Coal

|

Gas

|

Renewables

|

Total capacity

|

Gas % of total capacity**

|

Gas % of generation

|

|---|---|---|---|---|---|---|

| 2016 | 4,840 | 11,828 | 917 | 17,585 | 67% | 62% |

| 2020 | 3,400 | 15,250 | 1,550 | 20,200 | 80% | 73% |

| 2025 | 3,400 | 18,600 | 3,800 | 25,800 | 82% | 82% |

| 2030 | 3,400 | 23,900 | 6,100 | 33,400 | 83% | 83% |

| 2040 | 3,400 | 36,300 | 10,600 | 50,300 | 86% | 84% |

* Israel and Palestinian self-generation.

** Effective total capacity, with renewable capacity adjusted by a factor of 1:5 to reflect effective maximum availability

GAS FOR COGENERATION AND INDUSTRY GAS

Several major development projects for cogeneration plants are been initiated by Israel’s industrial sector, but most have been postponed due to a shortage of gas and an inability to complete financial closure without firm long-term gas contracts. The entry of Leviathan gas into the market will therefore facilitate the continued expansion of Israeli industry, which without gas suffers from its relative cost disadvantage as compared with overseas competitors who use natural gas.

In parallel, the Israeli government is taking steps to expand the country’s gas transmission distribution network in order to enable small and medium-sized industrial and commercial customers to shift to gas. In September 2016, the government declared an intension to provide NIS 300 million (USD 80 million) to assist the private sector in financing the construction of the gas transmission network.

GAS FOR TRANSPORTATION

The increased availability of natural gas is expected to lead to structural changes in Israel’s energy sources for transportation. Today, diesel and gasoline constitute the only fuels used for transportation in Israel. Israel Railways, the state-owned national railway system, has begun a process converting its entire network from diesel to electric trains. A new electric light rail system in Tel Aviv is also under construction, with the first line (Red Line) planned to begin operation in 2021. In addition, the Israeli government has adopted a policy aimed at promoting CNG and electric vehicles. The government is providing incentives and subsidies to build CNG based fueling stations and to adopt CNG based vehicles, mainly in urban truck and bus fleets.

The global vehicle market is on the verge of a shift to the usage of electric-powered smart vehicles. As a small and densely populated country, Israel has a comparative advantage for becoming an early adopter of electric vehicles. Electric vehicles also enjoy significant tax incentives. The adoption in July 2016 of a new standard that will allow charging of electric vehicles using standard power outlets, rather than dedicated charging stations, has removed a significant barrier that prevented the adoption of electric and plug-in vehicles in Israel. Our forecast is based on an assumption that by 2030, 15% of the Israeli transportation fleet will be powered by electricity, thus supporting higher electricity and gas demand consumption.

THE ISRAELI GOVERNMENT’S NATURAL GAS OUTLINE PLAN

In 2016 the Israeli government approved a Natural Gas Framework Plan with the goal of creating competition in Israel’s natural gas market. The main concept underlying the Plan was to create separate ownership of the natural gas reservoirs offshore Israel and to encourage competition. In addition, the Framework was designed to established a stable regulatory regime.

Click here for the Regulatory Filling on the Natural Gas Framework Plan.

ISRAELI GOVERNMENT’S VISION OF THE NATURAL GAS MARKET

HIGHLIGHTS OF THE NATURAL GAS FRAMEWORK

OWNERSHIP

Leviathan: ownership to remain unchanged.

Tamar:

- Delek to sell holdings (31.25%) within 6 years (by December 2021)

- Noble Energy to reduce stake to 25% from 36% (by December 2021)

Tanin and Karish (Completed in 2016):

- Delek and Noble to sell entire holdings within 14 months

- The export quota of these reservoirs (47BCM) will be transferred to Leviathan

PRICING AND CONTRACTS

- Existing offtake agreements will not be reopened

- For the interim period until the interest in Tamar is sold, offtakers of the new contracts can choose between the following price structures:

- Average domestic market price (Israeli Hub)

- Price formula linked to Brent (primarily for industry offtakers)

- PUA (average price and indexation of natural gas sold to independent electricity producers)

- Price (and linkage) in accordance with the export price agreements

- Taxation: Clarity on the calculation of Petroleum Profit Tax on exports

ISRAELI E&P FISCAL REGIME FOR OIL AND GAS

Royalties: State royalties of 12.5% of production calculated at the wellhead value; (effective rate of approximately 11-12%)

Petroleum Profit Tax (Sheshinsky Tax):

- Tax based on an R-Factor formula

- R-Factor calculated as (Cumulative Net Income) / (Cumulative Investments)

| R-Factor | < 1.5 | 1.5 to 2.3 | > 2.3 |

| R-Factor Tamar | < 2.3 | 2.3 to 2.8 | > 2.8 |

| Levy | 0% | 20% to 46.8% | 46.8% |

- R-Factor of 1.5 to 2.3 (or 2.3 to 2.8 for Tamar): 20% tax + 37.5% * (R Factor – 1.5 – or 2.3 for Tamar)

- Maximum Petroleum Tax: 50% – 0.64 * (Corporate Tax Rate – 18%). Please note that the maximum petroleum tax rate is subject to the Corporate Tax Rate that is reduced from 25% in 2016, to 24% in 2017 and 23% in 2018 (23% corporate tax rate will result in 46.8% maximum petroleum tax).

Tax (Dependent on Tax Structure)

- Current Corporate Tax rate: 24%

- Double taxation avoidance treaties with most of western countries

DELEK EXPORT MARKETS

ISRAEL’S NATURAL GAS EXPORT POLICY

In June 2013, the Israeli government adopted the main recommendations of the Zemach Commission regarding the Israeli government’s natural gas export policy. According to this plan:

- The total gas quantity that can be exported is limited to 360 BCM. This quantity may be increased if and when additional fields are discovered.

- The amount of natural gas required to guarantee local supply is 540 BCM. This volume is based on 29 years of projected domestic demand.

- To supply this minimum volume, each reservoir within Israeli waters is required to retain a percentage of its production for the local market based upon the size of the reservoir, as follows:

| Volume of Natural Gas in the Reservoir | Minimum rate of supply to the domestic market of the volume of natural gas in the reservoir |

|---|---|

| More than 200 BCM (inclusive) | 50% |

| Equivalent to or exceeding 100 BCM, but less than 200 BCM | 40% |

| Equivalent to or exceeding 25 BCM, but less than 100 BCM | 20% |

| Less than 25 BCM | To be fixed by the Commissioner of Petroleum Affairs |

- Swaps between reservoirs are allowed as long as the above-mentioned volume requirements are met and each reservoir reserves at least 25% of its volume for the local market.

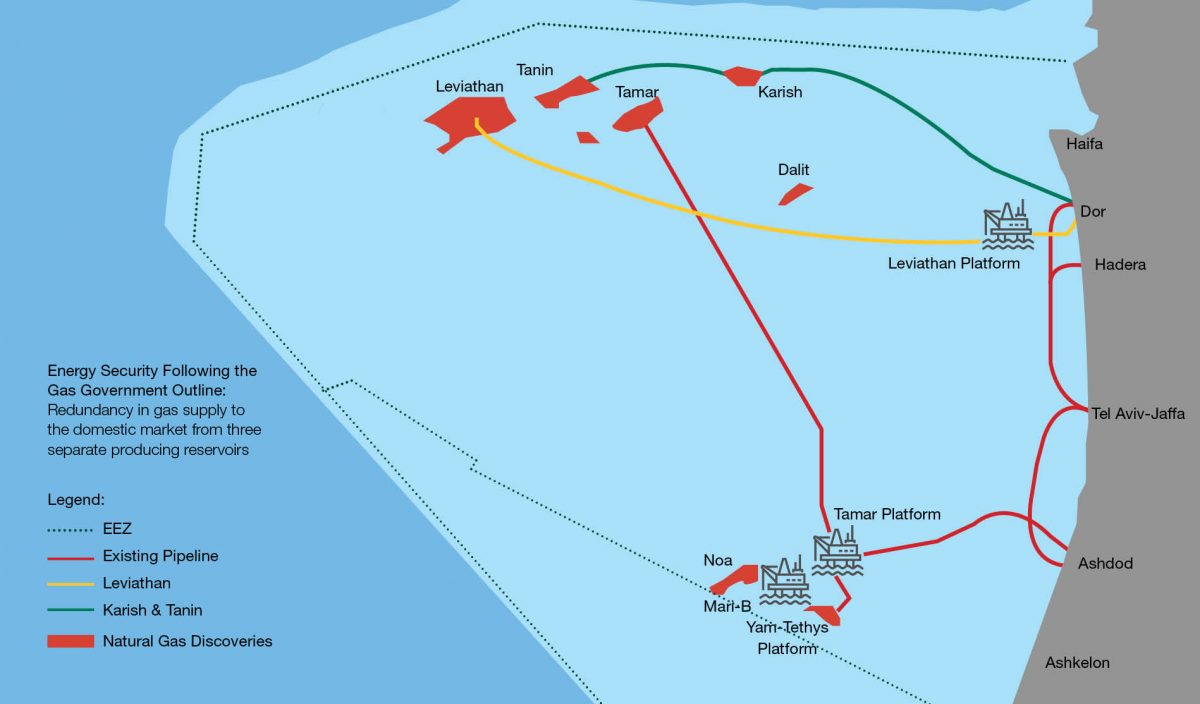

- All gas fields developed within Israeli territory and/or its EEZ will be connected to Israel’s national gas transmission network.

OVERVIEW OF DELEK GROUP’S POTENTIAL EXPORT MARKETS

Egypt:

The quantity of proved reserves in Egypt is estimated at 65 TCF and there is a potential for further significant discoveries. In 2015, the Zohr natural gas reservoir was discovered in Egypt, but as of the report publication date of the Company’s 2016 Annual Report, the size of the recoverable reserves have yet to be published. The Zohr reservoir is in the development stage and the estimation is that its initial development stage will be completed by 2018, then production and sale of natural gas to the local Egyptian market will begin. The reservoir may in future be a significant natural gas supplier to the relevant Egyptian export market from Israel and thereby affect the ability of the Partnerships to export natural gas from their reservoirs.

The Company estimates that in 2016 the local production in Egypt was 40-45 BCM whereas the local demand was higher than 50 BCM. In addition to natural gas for local use, Egypt has two natural gas liquefaction facilities to manufacture LNG for export, with a total liquefaction capacity of 12.2 tons of LNG annually for which 18-19 BCM of feed gas is required annually, and which as of the report publication date operate at low capacity or do not operate at all, because of the shortage of feed gas in Egypt. The projected demand for the local Egyptian market in 2020 ranges between 65 BCM and 75 BCM, excluding the natural gas required as feed gas for liquefaction in the liquefaction facilities.

To the best of the Company’s knowledge, to overcome the natural gas shortage in Egypt, the Egyptian government is acting in several parallel channels, including encouraging the development of existing discoveries, encouraging natural gas exploration in Egypt and importing LNG. The natural gas exploration operations being promoted by the Egyptian government may increase and accelerate the natural gas exploration operation in Egypt and therefore additional natural gas discoveries may be made in Egypt.

Regarding the import of LNG, two active floating LNG gasification facilities are currently used in Egypt to import natural gas, which are located in the Suez Canal. The estimation is that Egypt also purchases shipments of LNG, which are gasified in Jordan and then transferred to Egypt through the existing pipeline between the two countries.

For information regarding agreements to export natural gas to Egypt, see the Company’s 2016 Annual Report sections 1.7.13(E)(1)b and 1.7.13(E)(2)b.

Delek is directly and indirectly promoting different alternatives to export natural gas through the EMG pipeline, either by signing an agreement for transfer fees or through a transaction with the rights holders of the EMG pipeline, and/or through the existing gas pipeline between Jordan and Egypt and/or a special pipeline to be construction as part of the INGL transmission system and connected to Egypt in the Kerem Shalom region.

In order to overcome the shortage, the Egyptian government has initiated activities in a number of directions: encouragement of exploration in Egypt, development of existing discoveries, and import of natural gas.

Tamar Partners and Union Fenosa Gas have signed a non-binding LOI to negotiate the supply of 4.5BCM/Y (435 mmcf/d) per year for 15 years, with an option to increase the supply up to 7BCM/Y (677 mmcf/d), from Tamar to UFG’s liquefaction facility (Damietta) in Egypt.

On June 27, 2014, a non-binding letter of intent was signed between the Leviathan partners and BG International Limited, which was acquired in 2015 by Shell, under which the parties confirmed their intent to negotiate an agreement for the supply of natural gas from the Leviathan project by the Leviathan partners to Shell, to supply Shell’s liquefaction plant in Idku, Egypt. The estimated scope of the Binding Agreement, if signed, is for annual supply of 7 BCM over 15 years. The terms of the Binding Agreement have not yet been agreed upon, and the parties are continuing to negotiate for a Binding Agreement while assessing options to significantly increase the annual supply set out in the letter of intent, among other things, because, to the best of the Partnership’s knowledge, the maximum annual capacity of the liquefaction facilities could exceed 10 BCM. The parties are also assessing the revised price and linkage formula, and alternatives for infrastructure to export natural gas to Egypt.

Jordan:

The Company estimates that the demand for natural gas on the local Jordanian market in 2020 is expected to be 5-6 BCM annually, based on the estimates of external consulting firms. Jordan currently leases a floating gasification facility several kilometers south of Aqaba for the import of natural gas.

To the best of the Company’s knowledge, in 2015 Jordan signed several short-term agreements to import LNG in a volume of 3 BCM annually and in 2016, Jordan consumed 3.5 BCM natural gas mainly by importing LNG. Due to the close geographical proximity between Israel and Jordan, a relatively small investment is required to connect the INGL pipeline to the Jordanian pipeline at a point on the border between the countries.

For information regarding agreements signed for the supply to Jordan, see the Company’s 2016 Annual Report sections 1.7.13(E)(1)b and 1.7.13(E)(2)b.

Noble has signed (on behalf of the Leviathan Partners) an offtake agreement to supply 45 BCM/Y of natural gas to the National Electric Power Company of Jordan for 15 years.

Cyprus:

Cyprus is almost completely dependent on imported oil products and electricity production in Cyprus is mainly based (90%) on burning oil-based products, such as diesel fuel. Cyprus also has difficulty in connecting to the European energy infrastructure due to its geographic location and being an island.

In 2007, the Cypriot government set up the Natural Gas Public Company (“DEFA”), which is exclusively responsible for the import, storage, marketing, transportation, supply and trade of natural gas in Cyprus, including management of the Cypriot natural gas distribution system. Under regulations established in 2007 concerning the Cypriot natural gas market, this gas company has exclusivity to import and market natural gas in Cyprus.

Currently, Cyprus does not use natural gas. However, the Aphrodite discovery created a possible local source of natural gas in Cyprus, but due to the expected volume of investments required to develop the field and the limited size of the potential Cypriot local market, developing the discovery and supplying natural gas to the Cypriot market apparently depends on the ability of the Cypriot authorities to promote the construction of export infrastructure to justify development and commercialization of the discovery. In the absence of relevant regulation in Cyprus with respect to natural gas export facilities, it is impossible to estimate how additional discoveries, if any, could affect the manner of exporting gas from Cyprus and the competition, should it develop, with respect to the local market and access to export infrastructure.

To the best of the Company’s knowledge, the Cypriot government and electric company are taking steps to promote replacing fuel-based products with natural gas to produce electricity. As of the report publication date, Delek, together with the other Aphrodite reservoir partners, is negotiating with DEFA for an agreement to supply natural gas to Cyprus from the Aphrodite reservoir.

Turkey:

In 2015, the natural gas consumption in Turkey was 48 BCM and the estimation is that in 2016 it was 46 BCM after increasing by more than 10 BCM since 2009. Turkey is completely dependent on importing natural gas and LNG as a solution for its local demand for natural gas. Turkey is acting to diversity its sources of supply and to become a transition country of natural gas by pipeline to Central and Western Europe, and it recently started operating a floating LNG gasification facility that will, to a certain degree, enable it to increase the capacity to import LNG.

Delek is negotiating with various entities on the Turkish market for the supply of natural gas to the Turkish market from the Leviathan reservoir, and with officials in the Turkish government regarding the export of natural gas to Turkey in a project that will include construction of an offshore pipeline from Israel to Turkey for the sale of natural gas to the Turkish market.

SUGGESTED LINKS

INTERNATIONAL E&P

Click here for detailed information regarding Delek’s international E&P business.

INVESTORS

Click here to access our Investor Relations Center.