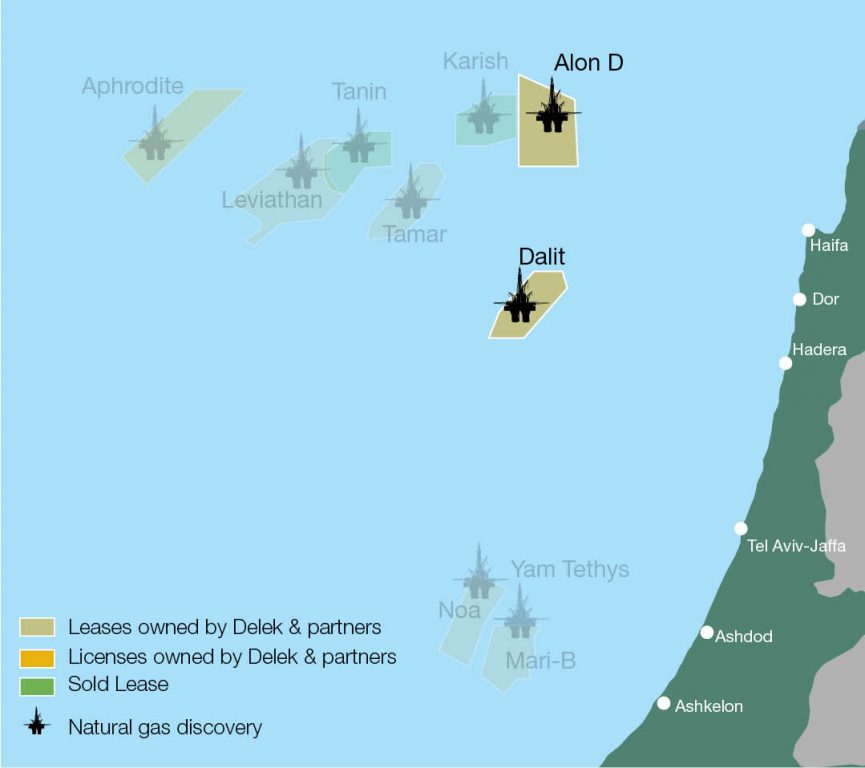

EAST MED E&P: OUR ASSETS

LEVIATHAN

THE LEVANT BASIN’S GAME-CHANGING DISCOVERY

OVERVIEW

Reserves1

- Natural Gas (2P+2C) – 21.4 TCF (606 BCM)

- Condensate (2P+2C) – 39.4 MMBOE

- Condensate Yield – 2.0 BBL/MMcf

- Deep Mesozoic prospective resources: ~4 TCF and 560 MMBBLO (Best Estimate)2

Status

- FID for the development of Phase 1A sactioned by Leviathan Partners

- Leviathan 3 & 4 – appraisal wells executed successfully

- Production wells – Leviathan 5 executed successfully; Leviathan 3 & 7 to be completed in 2018

Development Cost of Phase 1 (21 BCM/Y, 2.1 Bcf/d) (100%):

- ~USD 5.25 – 5.75 bn

See details below

Location and Area:

- Offshore asset located 130-140 km west of Haifa, Israel

- Approximately 330 sq. km

1 Reserves and resources are as of 31.08.2017, according to NSAI

2 Resources are as of 31.12.2014, according to NSAI

DEVELOPMENT PLAN

Leviathan’s Revised Development Plan:

- Phase I: Single Fixed Platform with initial maximum production capacity of 21BCM/Y (2.1Bcf/d)

- High level of modularity

- Phase 1A (FID sanctioned) (for Israeli, Jordanian & Palestinian Authority markets): maximum production capacity of 1,200 mmcf/d at a cost of ~USD 3.75 bn

- Phase 1B (for the export market): additional capacity of 900 mmcf/d for a total capacity of ~2,100 mmfc/d at a total cost (Phase 1A and 1B – 100%): ~USD 5.25 – 5.75 bn

- Possibility of integrating drilling to deeper oil targets via an agreement with a drilling rig

WORKING INTEREST

Delek Group’s economic interest in Leviathan is 25.48%

OFFTAKE AGREEMENTS: SIGNED AND UNDER NEGOTIATION

| Consumer | Type | Status | Actual/ Expected Start Date | Duration (Years) | Option for reduction | TCQ (BCM) | |

|---|---|---|---|---|---|---|---|

| NEPCO (Jordan) | National Utility | Signed | First commercial gas | 15-17 | No | 45 | |

| IPM | IPP | Signed | First commercial gas | 18-20 | Yes | 13 | |

| Edeltech | Cogen | Signed | First commercial gas | 18-20 | Yes | 6 | |

|

Phase 1A

|

PAZ | Industrial-Cogen | Signed | First commercial gas | 15-16 | Yes | 3 |

| Or Energies (Dalia) | IPP | Signed | As soon as IPP is built | 20 | Yes | 9 | |

| Dolphinus Holdings | Industrial | Under Negotiations (Non-binding LOI) | Up to 4BCM/Y for 10-15 Years | ||||

|

Phase

1B |

ELNG Shell (Egypt) | LNG facility | Under Negotiations (Non-binding LOI) | ||||

All of the agreements have a floor rate.

ISRAEL GOVERNMENT’S NATURAL GAS FRAMEWORK

According to the Israeli Natural Gas Framework approved by the Israel Government, Delek’s ownership in Leviathan is to remain unchanged.

To learn more about East Med E&P Business Environment please click here.

LEVIATHAN’S DISCOUNTED CASH FLOW (DCF) MODEL

With its FID in place, Leviathan is positioned to become Delek 's powerful growth engine for the next decades.

TAMAR

BROUGHT ENERGY INDEPENDENCE TO ISRAEL

OVERVIEW

Reserves1

- Natural Gas (2P) – 11.2TCF (318 BCM)

- Condensate (2P) – 14.6MMBOE

- Condensate Yield – 1.3 BBL/MMcf

Status

- World-class project execution: from find in 2009 to flow in March 2013

- Evaluating expansion alternatives of up to 20.4BCM/Y (1,974 mmcf/d)

- Successful USD 2bn 144A bond raise

Development Cost:

- USD 3.2bn (100%)2

Well Production Capacity:

- >250MMCF/D each (6 wells)

Production Capacity:

- Phase 1: ~1.0 Bcf/d (maximum of 1.15 Bcf/d)

Location and Area:

- Offshore asset located 90km west of Haifa, Israel

- Approximately 100 sq. km

1 Reserves are as of 30.06.2017 and include Tamar SW, according to NSAI. Reserves do not include resources in the area of the Eran License.

2 Development budget up to first gas (as of March 2013).

OFFTAKE AGREEMENTS: SIGNED AND UNDER NEGOTIATION

| Consumer | Type | Status | Actual/ Expected Start Date | Duration (Years) | Option for reduction | TCQ (BCM) | |

|---|---|---|---|---|---|---|---|

| Israel Electric Corporation | Power | Signed | 2013 | 15-17 | No | 87 | |

| Dalia Power Energies Ltd | IPP | Signed | 2015 | 17-19 | Yes | 23 | |

| IPP & Electricity Related | IPP | Signed | 2013-2020 | 15-17 | Yes | 58 | |

| Oil Refineries Ltd | Industrial /Industry (Refinery) | Signed | 2013 | 7-9 | No | 6 | |

| Industrial | Industrial | Signed | 2013 | 7 | No | 1 | |

| Marketing Companies | Marketing | Signed | 2013-2016 | 5-7 | 2.3 | ||

|

Domestic 60%

|

Total | ||||||

| Arab Potash & Jordan Bromine | Industrial/Industry | Signed | 2016 | 15-17 | No | 2 | |

| Dolphinus Holdings | Industrial/Industry | Signed | Subject to infrastructure availability | 7 | No | 5 BCM for first 3 years | |

|

Export 40%

|

Union Fenosa | LNG facility | Under Negotiations (Non-binding LOI) | ||||

All of the agreements have a floor rate.

WORKING INTEREST

Delek Group’s economic interest in Tamar is 14.44%

ROBUST CONTRACTUAL STRUCTURE: DOMESTIC MARKET

Israel Electric Corp.

Israel Electric Corp.

- TCQ: 87 BCM (~3.07 TCF)

- 15-17 years

- Price linked to US CPI

Mechanism for price adjustment in 2021 and 2024

IPP & Electricity Related

IPP & Electricity Related

- TCQ: 81BCM (~2.86 TCF)

- 15-19 years

- Price of majority of contracts linked to electricity index

Mechanism for quantities adjustment between 2018 and 2021

Industry & Other

Industry & Other

- TCQ: 11 BCM (~0.4 TCF) + Condensate

- 5-9 years

- Price of majority of contracts linked to price of Brent

CAPACITY EXPANSION – UNLOCKING FURTHER VALUE

Delek Group and its partners are currently evaluating alternatives for expanding the production capacity of its Tamar lease to up to 20.4BCM/Y (1,974 mmcf/d). This expansion will enable Tamar to increase its supply of natural gas to the Israeli market while also potentially feeding natural gas to the liquefaction plant of Union Fenosa Gas (Damietta) in Egypt.

The Tamar Partnership is currently in negotiations with Union Fenosa Gas to supply 4.5 BCM of natural gas per annum for a period of 15 years with an option to increase to 7 BCM per annum.

Estimated cost of the capacity expansion plan: up to USD 2 billion.

Estimated FID to first gas: 24 months

ISRAEL GOVERNMENT’S NATURAL GAS FRAMEWORK

According to the Israel Natural Gas Framework approved by the Israeli Government, Delek is permitted to undertake the Tamar Expansion project, and must divest all of its holdings in Tamar by 2021.

To learn more about East Med E&P Business Environment please click here.

TAMAR’S DIVESTMENT PROCESS

As per the Natural Gas Framework Plan, in July 2017, Tamar Petroleum, a special purpose company established by Delek Group’s partnership, Delek Drilling LP, commenced trading on the Tel Aviv Stock Exchange, following a successful IPO, under the ticker ‘TMRP’. Delek Drilling sold its working interest of 9.25% in the Tamar and Dalit Leases to Tamar Petroleum. In exchange, Delek Drilling received approximately NIS 3 billion (approximately USD 850 million) as well as a shareholding in Tamar Petroleum amounting to 40%. As a result, Delek Group will recognize an after-tax profit attributed to the Company’s shareholders of approximately NIS 800 million in the third quarter of 2017. This amount also includes the estimate of the fair value of the Group’s entitlement to receive future production-based royalties for the rights sold to Tamar Petroleum.

Delek Group’s partnership is continuing to assess various alternatives for the sale of the balance of its remaining holdings in Tamar and Dalit.

TAMAR’S DISCOUNTED CASH FLOW (DCF) MODEL

Tamar’s operations added 1% to Israel’s GDP in its first year of production (2013).

APHRODITE

CYPRUS’S 1ST NATURAL GAS DISCOVERY

OVERVIEW

Reserves*

- Natural Gas – 4.5 TCF (128 BCM)1

- Condensate – 9 MMBOE1

- Condensate Yield – 2.0 BBL/MMcf

Status

- Discovery in 2011 (1st well ever drilled off-shore in Cyprus)

- Aphrodite A-2 appraisal well, DST & seismic survey completed in 2013

- Development plan submitted

Development cost:

- ~USD 2.5 – 3.5 bn: According to the Operator’s estimate, which was submitted to the Partnerships and the Cyprus government, and prior to completion of the techno-economic feasibility plan, which includes an FEED, the estimated cost of the development plan, excluding the construction cost of the pipeline to the target markets, is between USD 2.5 – 3.5 bn (100%).

Location and Area:

- Offshore asset located in the exclusive economic zone of Cyprus 35km north west of Leviathan reservoir

- Approximately 70 sq. km

1 Reserves are as of 30.09.2014, according to NSAI.

DEVELOPMENT PLAN

- Floating host facility with a capacity of 800 mmcf/d

- Natural gas to be exported via pipelines

- Targeting regional sales

WORKING INTEREST

Delek Group’s economic interest in Aphrodite is 16.86%

OFF-TAKE AGREEMENTS:

Aphrodite: Cyprus’s 1st-ever offshore-drilled exploration well natural gas discovery

OTHER ASSETS

KARISH & TANIN

Leases:

- Karish –1.8 TCF (contingent and prospective resources as of June 30, 2013, according to NSAI)

- Tanin – 1.2 TCF (contingent and prospective resources as of December 31, 2014, according to NSAI)

Status:

- Sold to Energean Israel Oil & Gas Ltd. (see Regulatory Filling)

- Delek Group entitled to overriding royalties from Karish & Tanin’s future production*

* To view the Valuation report of the contingent consideration and existing royalties under the agreement to sell all rights in leases I/17 Karish and I/16 Tanin, please see section 1.7.8 of Delek Group’s 2016 Annual Report under our Results Center.

ADDITIONAL PROSPECTS

Licenses:

- Dalit – 0.5 TCF (contingent and prospective resources as of December 31, 2012)

- Status – lease

- Working interest:

- Delek Drilling – 22%1

- Noble Energy (Operator) – 32.50%

- Isramco – 28.75%

- Dor – 4%

- Everest – 3.5%

- Economic interest: 14.44%

- Alon D

- Status – exploration license granted through April 2020

- Working interest:

- Delek Drilling – 52.941%2

- Noble Energy (Operator) – 47.059%

- Economic interest: 29.75%

1Delek Group’s economic interest in Dalit is 14.44%.

2Delek Group’s economic interest in Alon D is 29.75%.

SUGGESTED LINKS

INTERNATIONAL E&P

Click here for detailed information regarding Delek’s international E&P operaions.

INVESTORS

Click here to access our Investor Relations Center.